SAN ANTONIO – One of the early investors of Integrity Aviation, the company at the center of a federal lawsuit filed by investigators from the United States Securities and Exchange Commission, said she lost hundreds of thousands of dollars in the alleged Ponzi-scheme.

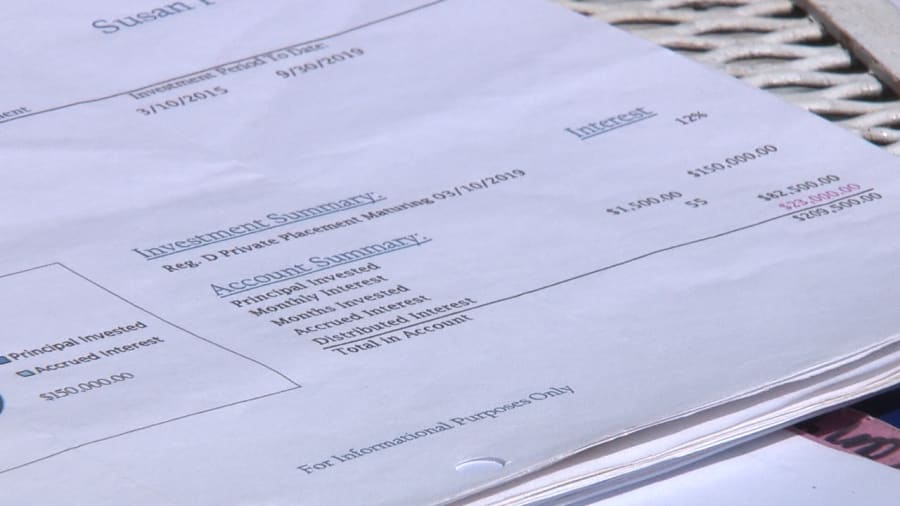

Susan Perez provided records showing she invested a total of $380,000 in the Boerne-based aviation asset business, using retirement funds left by her late husband, a San Antonio Fire Department captain who died following complications from routine surgery in 2011.

“First of all, I feel cheated, angry. I feel like a let Ralph down,” said Perez, referring to her late husband.

Perez is one of the close to 90 investors across five states who were led to believe their money was being used to buy and then refurbish jet engines, which would then be leased to the major airlines, netting 12 percent annual returns in the process.

“Apparently leasing is the way to go for these big corporations,” said Perez, recalling the marketing pitch she was given several years ago while deciding whether she should invest.

Perez did invest, making five deposits in all, and said she recommended the business venture to other people she knew, unaware that only a small amount of funds were going toward buying aviation assets.

According to the SEC lawsuit filed against Integrity Aviation and owner Victor Lee Farias in San Antonio federal court last month, regulators could find no record that a single aircraft engine had been purchased by the company since 2015.

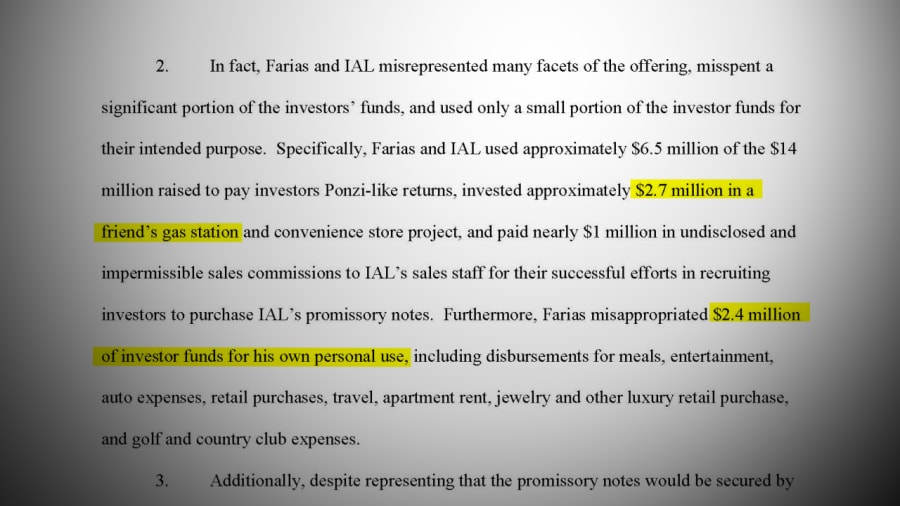

Instead, regulators said Farias used nearly half of the $14 million raised to pay investors Ponzi-like returns.

He’s accused of funneling another $2.7 million into a friend’s gas station project.

A lawsuit filed in Bexar County district court last week is attempting to recoup those funds, which would then be turned over to some of Farias’ victims.

They were awarded more than $8 million combined as part of a default judgment against Farias earlier this year.

Perez, one of the plaintiffs in that suit, said to date she has only received a single check for $10,000.

A second lawsuit filed against Farias in Bexar County district court is pending, according to an attorney representing those investors.

In all, 50 investors have filed suit against Farias in Bexar County.

Farias, who told the KSAT 12 Defenders via email he is cooperating with the SEC and has made it a priority to pay restitution to his clients, is also accused of using $2.4 million of investor funds for his personal use.

SEC investigators also claim in their suit against Farias that he used a carefully cropped image of an SEC investigative subpoena as “proof” to one investor that he was taking the company public.

The SEC lawsuit asks the court to require Farias to discharge “all ill-gotten gains” from the scheme, require him to a pay a fine and bar him from issuing certain securities in the future.

Federal records show Farias was served a summons and the civil complaint August 5, while Integrity Aviation was served a day later.

Farias has until next week to answer the complaint, court records show.

He has not been criminally charged in connection to the scheme.

A source, however, said the FBI is looking into Farias.

A spokeswoman for the San Antonio office of the FBI said via email this month she could neither confirm nor deny whether an investigation was taking place.

While some investors were given monthly annuity checks, Perez said she made only two withdrawals totaling $23,000 and had hoped to take a lump sum payment after the promissory notes she signed had fully matured.

Based on Perez’s financial records viewed by the Defenders, her $380,000 investment would have generated a more than $150,000 profit over four years.

As of now, Perez only has $33,000: her two withdrawals and the $10,000 check she received following the default judgment.

Perez now says it’s unlikely she will ever get back even her base investment.

She shared text messages sent between her and Farias as recently as October.

In the messages, Farias wrote that he made bad business decisions and was institutionalized after the company failed.

Farias also wrote that he had been beaten up twice, had the tires on his vehicle slashed and windows in his cars and house shot out.

Farias declined to elaborate on the alleged incidents when asked about them by the Defenders.