If you’ve turned on the news or read the paper over the past several months, you’ve probably noticed a topic that has repeatedly been in the news: property taxes.

From complaints about how swiftly they are rising, to reform efforts made on the state and local levels, there has been no shortage of headlines referencing residential property taxes.

The topic may not seem like the flashiest or most interesting, but it is important and something that affects most of us. That’s why the KSAT News at 9 team decided to dive into it.

Property taxes are complex and can be confusing. It’s a subject that deserves more than a minute in a newscast.

We talked to local homeowners and experts, looked at data and even played with Legos to break down all you need to know about property taxes.

Bexar County property values

There’s a reason you’ve been reading so much about property taxes lately. Property values in San Antonio and Bexar County have been rising.

On average, single-home values in the county are up 8.7 percent. But what does that mean for you and how much you’ll pay in taxes? Here’s an example:

Property values have been going up across Bexar County, but some areas have felt the increase more than others.

We requested information from the Bexar County Appraisal District, breaking down the average residential property appraisal in 2014 and in 2019 by ZIP code.

Hover over a ZIP code to see the percentage increase for that area:

See the average property appraisal for your ZIP code in 2014 and 2019:

KSAT - Avg Residential 2014... by RJ Marquez on Scribd

‘Most of the neighbors have moved out already’: South Side and Denver Heights residents feel effects rising property values

KSAT spoke with residents on the South Side and East Side about how rising property values have affected them. Watch video below to hear their stories:

The basics of property taxes

Property taxes, at their most basic level, are pretty self-explanatory. They’re taxes on property you own.

Things get more complicated when you look at where that money goes, how it is used and what exemptions you can claim to pay less.

There is a seemingly simple formula that determines how much you have to pay in property taxes.

But it is not as simple as it seems. We’ve broken it down, using some well-known building blocks:

Where does the money go?

There is no state property tax in Texas. Instead, property taxes are paid to local governments, school districts and other taxing entities.

The money is collected by the county tax assessor-collector, who then divvies it up among those entities in the county. In Bexar County, there are more than 60 taxing entities:

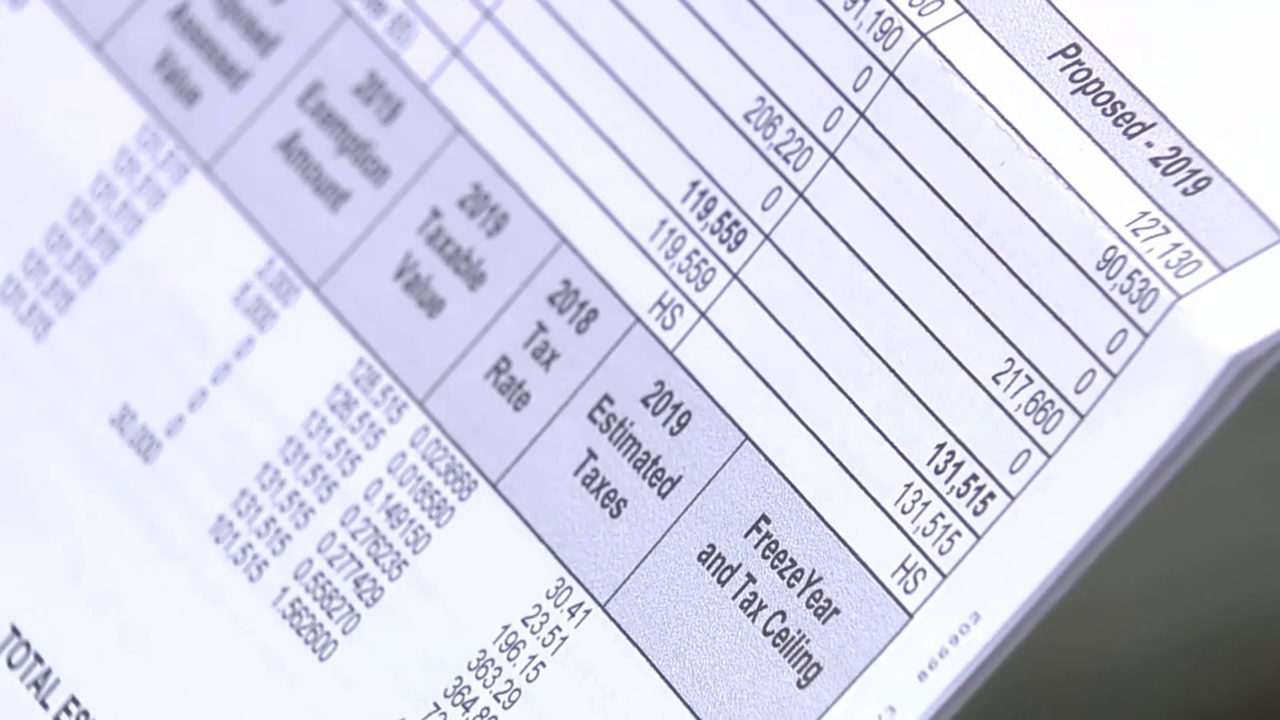

You don’t pay taxes to all of these entities. You only pay toward the entities in your specific district. Here’s an example of how much each taxing entity collects:

Exemptions and deferrals

There are ways property owners can try to reduce the amount of money they owe.

Exemptions reduce the market value of your property, which lowers what you are required to pay in taxes.

Both Bexar County and the city of San Antonio offer exemptions for residential properties.

The homestead exemption is probably one you’ve heard a lot about. But how does it work? Here’s an example:

If your home is valued at $150,000 and you qualify for a $25,000 exemption, you would only pay taxes on the home as if it were worth $125,000.

Anyone can apply for this Bexar County exemption for their primary residential property. You just have to fill out this form and turn it in to the Bexar County Appraisal District.

City of San Antonio homestead exemption

The city of San Antonio offers the same exemptions as the county and recently approved a homestead exemption for the first time.

San Antonio was the last major Texas city to implement a homestead exemption. The City Council approved a 0.01% exemption of your home’s value.

It may seem like a drop in the bucket, but Councilmen Clayton Perry and John Courage say it is a start.

The 0.01% homestead exemption will take roughly $6 million from the city’s total budget for the next fiscal year.

City study on property appraisal process

The city of San Antonio is reviewing how the Bexar County Appraisal District operates.

Council members asked for the review in light of soaring property taxes.

The review will also look at how appraisal districts work in other Texas counties.

A report on the review is supposed to be given to the City Council in September.

How to dispute your appraisal

There is another way homeowners can save money on property taxes: Dispute the value of your home if you disagree with it.

To file an appeal, you have to fill out a Notice of Protest by midnight on May 15. The form arrives in the mail with your notice of appraised value, which is sent in April.

Homeowners can either do an informal hearing with an appraiser or a formal hearing in front of the appraisal review board.

Both hearings require you to bring evidence showing why you believe your property isn’t worth as much as it was appraised for.

This evidence can include appraised values of other nearby homes, photos and recent estimates of internal or external damage.

Legislative reform efforts

Texas state lawmakers made property tax reform a top priority during the last legislative session.

The Legislature finally passed changes at the state level. But what are those changes and what do they mean? A lot of it is about transparency.